44 coupon rate and yield

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Below are the steps to calculate the Coupon Rate of a bond: Step 1: In the first step, the amount required to be raised through bonds is decided by the company, then based on the target investors (i.e. retail or institutional or both) and other parameters face value or par value is determined as a result of which, we get to know the number of bonds that will be issued. Coupon vs Yield | Top 5 Differences (with Infographics) Difference Between Coupon and Yield. Coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held till ...

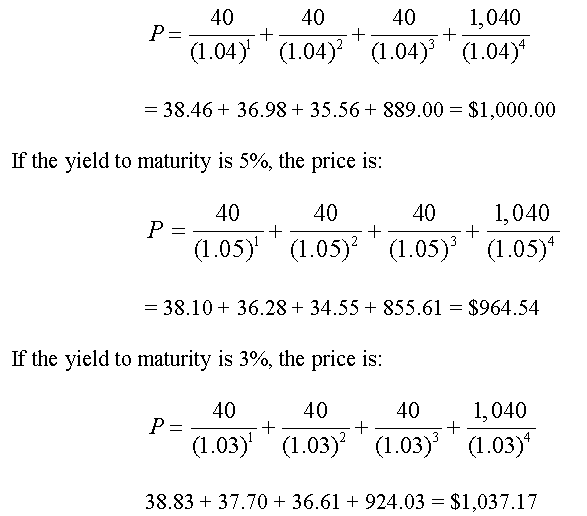

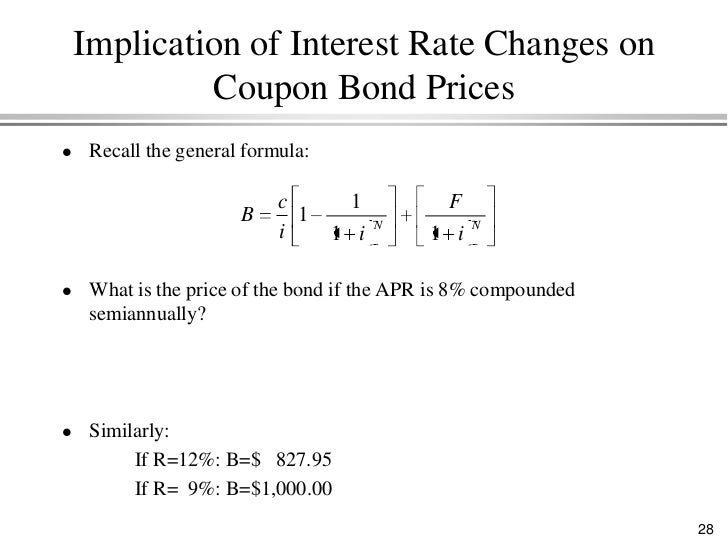

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value...

Coupon rate and yield

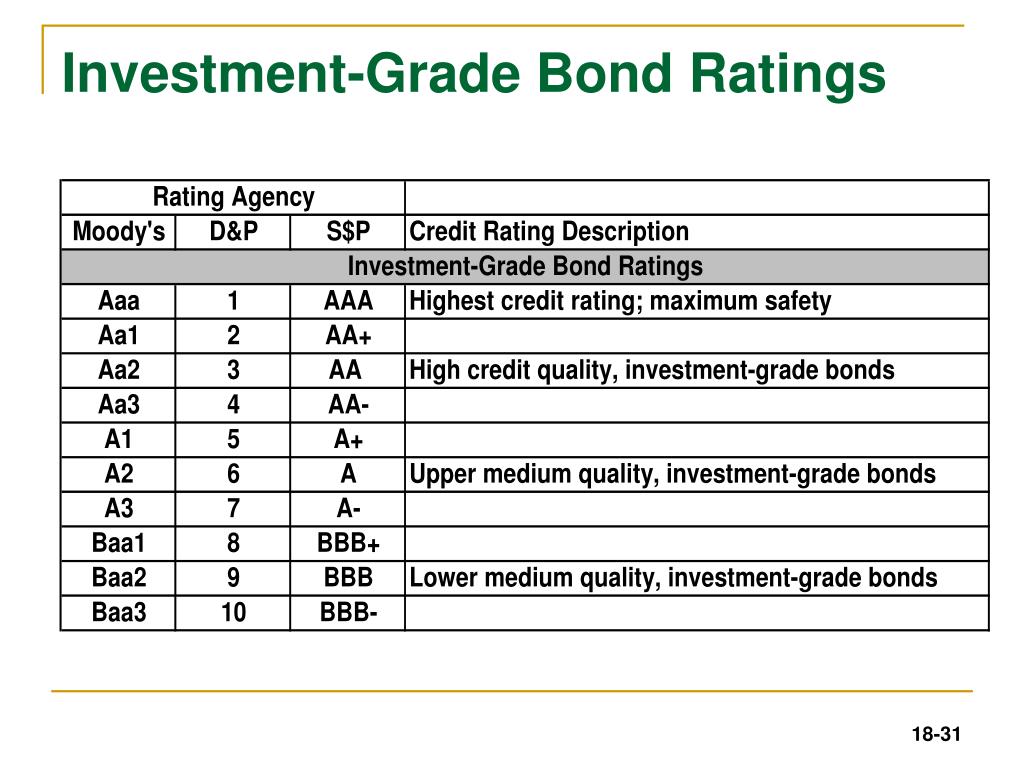

C its yield to maturity is higher than its coupon rate D its coupon ... Coupon rate B. Coupon frequency C. Par value D. Yield to maturity Accessibility: Keyboard Navigation Blooms: Understand Difficulty: Easy Learning Objective: 06-02 Calculate the market price of a bond given its yield to maturity, calculate a bond's yield given its price, and demonstrate why prices and yields move in opposite directions. Difference Between Bond Yield and Coupon Rate (With Table) The main difference between Bond Yield and the Coupon rate is that Bond Yield is the return rate, whereas the Coupon Rate signifies the rate of interest to be paid annually. In simple terms, a bond's coupon rate shows the substantive interest merited on the bond. Bond Yield, or commonly known as Yield designates the revenue return on the bond. Yield To Maturity Vs. Coupon Rate: What's The Difference? Coupon Rate The coupon charge or yield is the quantity that buyers can count on to obtain in earnings as they maintain the bond. Coupon charges are mounted when the federal government or firm points the bond. The coupon charge is the yearly quantity of curiosity that shall be paid based mostly on the face or par worth of the safety.

Coupon rate and yield. Bond Yield Formula | Step by Step Calculation & Examples Suppose a bond has a face value of $1300. And the interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600. Face Value = $1300; Coupon Rate = 6%; Bond Price = $1600; Solution: Here we have to understand that this calculation completely depends on annual coupon and bond price. Bond Yield Rate Vs. Coupon Rate: What's The Difference? - ETEQ () Bond Yield Rate vs. Coupon Rate: An Overview A bond's coupon fee is the velocity of curiosity it pays yearly, whereas its yield is the velocity of return it generates. A bond's coupon worth is expressed as a proportion of its par price. The par price is solely the face price of the bond… Bond Coupon Difference IoB Rate Whats Yield Coupon Rate - Meaning, Calculation and Importance - Scripbox This article explains the coupon rate for bonds, its calculation, importance and difference between coupon rate and yield to maturity in detail. What is Coupon Rate in Bonds? The coupon rate for bonds is the interest bond issuer pays on the face value of the bond. In other words, it is the periodic interest that the issuer of the bond pays the ... What is the difference between coupon and yield? - Quora Answer (1 of 3): Coupon is the annual interest rate paid to bondholders. Yield is a measure of return based on coupon, purchase price, and maturity. Example: XYZ 4.00% bonds are due OCT 1 2028 trade at par ($100-00) At this price, the coupon rate 4.00% is equal to the Yield to maturity. * We...

Important Differences Between Coupon and Yield to Maturity The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). Coupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... What Is the Coupon Rate of a Bond? A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ... Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. 1. Overview and Key Difference. coupon and yield : bonds - Reddit Coupon refers to the stated interest rate of the bond. A 5% coupon is $50, etc. Yield refers to the % received buying the bond and can be measured on different end-points (yield to maturity, yield to worst, etc.), and is influenced by the purchase price of the bond (if you buy below par, the yield will be higher than the coupon, if you buy ... Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = Reference Rate + Quoted Margin The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be - Coupon Rate = 5-Year Treasury Yield + .05% Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) Difference Between Coupon Rate vs Interest Rate. A coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and ...

Coupon Rate: Formula and Bond Nominal Yield Calculator The coupon rate, or "nominal yield," is the rate of interest paid to a bondholder by the issuer of the debt. The coupon rate on a bond issuance is used to calculate the dollar amount of coupon payments paid, i.e. the periodic interest payments by the issuer to bondholders.

Presented below are annual coupon rates, yield rates, | Chegg.com Bond Coupon Rate Yield Rate Duration A 4.0 % 6.0 % 6 years B 10.0 % 8.0 % 10 years C 5.0 % 6.0 % 15 years D 8.0 %; Question: Presented below are annual coupon rates, yield rates, and expected duration for a series of debentures. Calculate the issuance price for each debenture assuming that the face value of each bond is $1,000 and that interest ...

Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

Current yield - Wikipedia Example. The current yield of a bond with a face value (F) of $100 and a coupon rate (r) of 5.00% that is selling at $95.00 (clean; not including accrued interest) (P) is calculated as follows.

Bootstrapping | How to Construct a Zero Coupon Yield Curve in ... Zero-Coupon Rate for 2 Years = 4.25%. Hence, the zero-coupon discount rate to be used for the 2-year bond will be 4.25%. Conclusion. The bootstrap examples give an insight into how zero rates are calculated for the pricing of bonds and other financial products. One must correctly look at the market conventions for proper calculation of the zero ...

Difference Between Current Yield and Coupon Rate The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the same.

Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

Post a Comment for "44 coupon rate and yield"