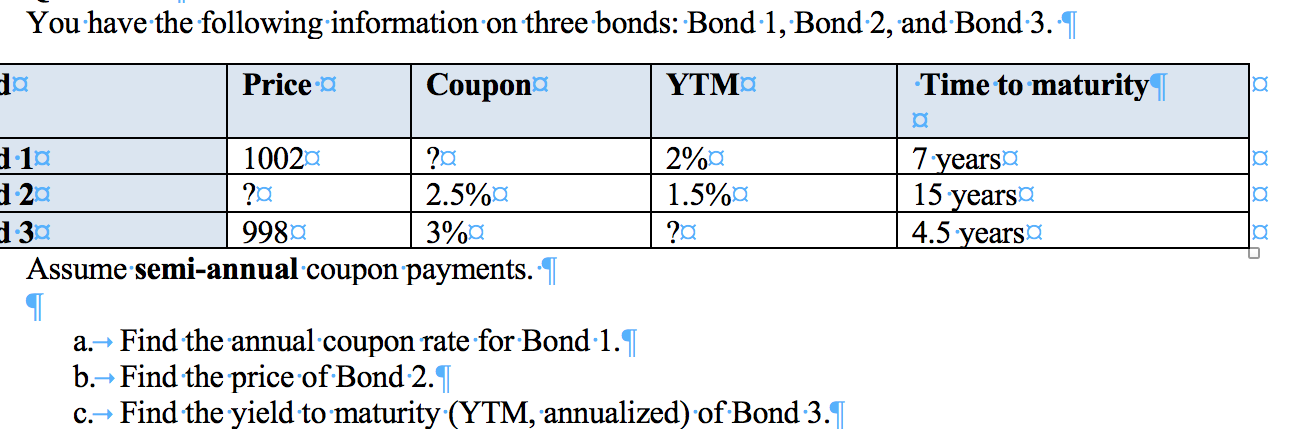

42 coupon rate vs ytm

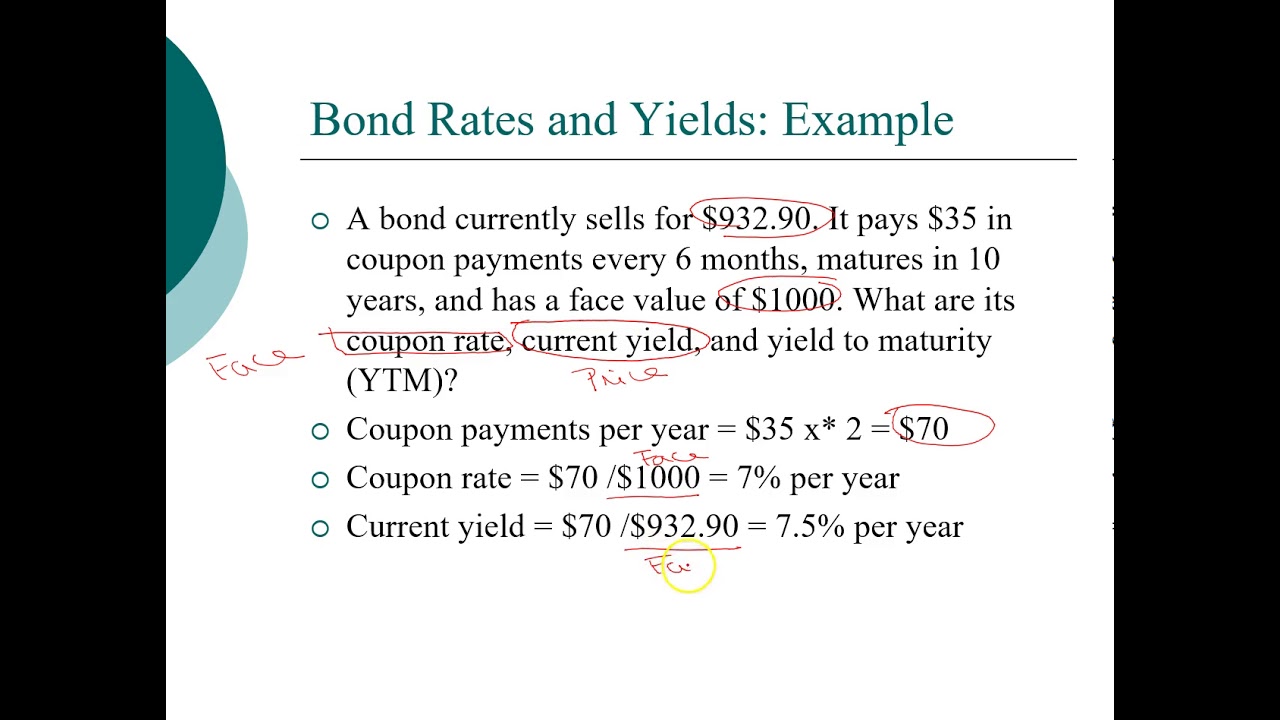

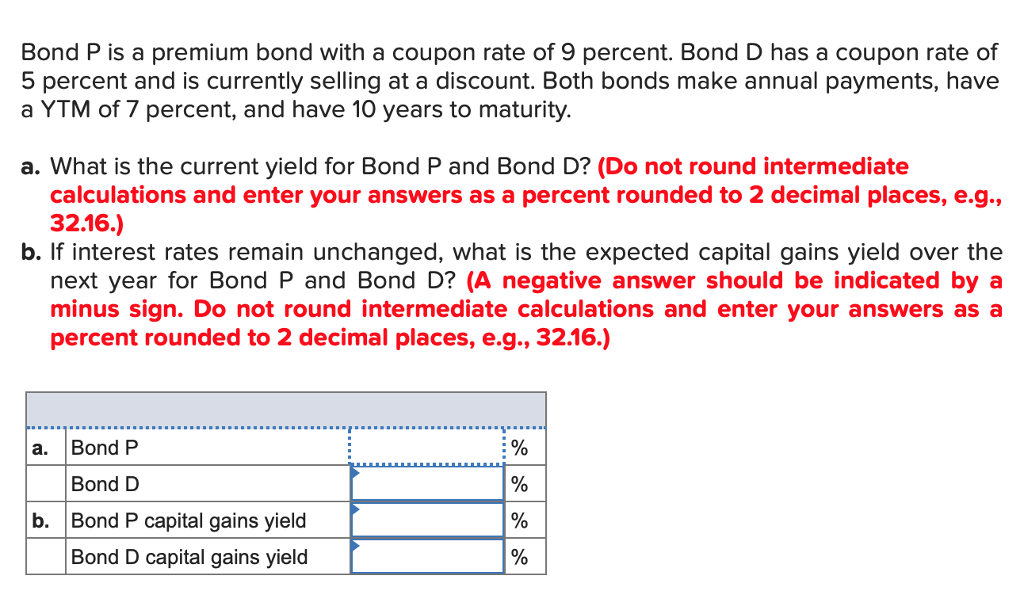

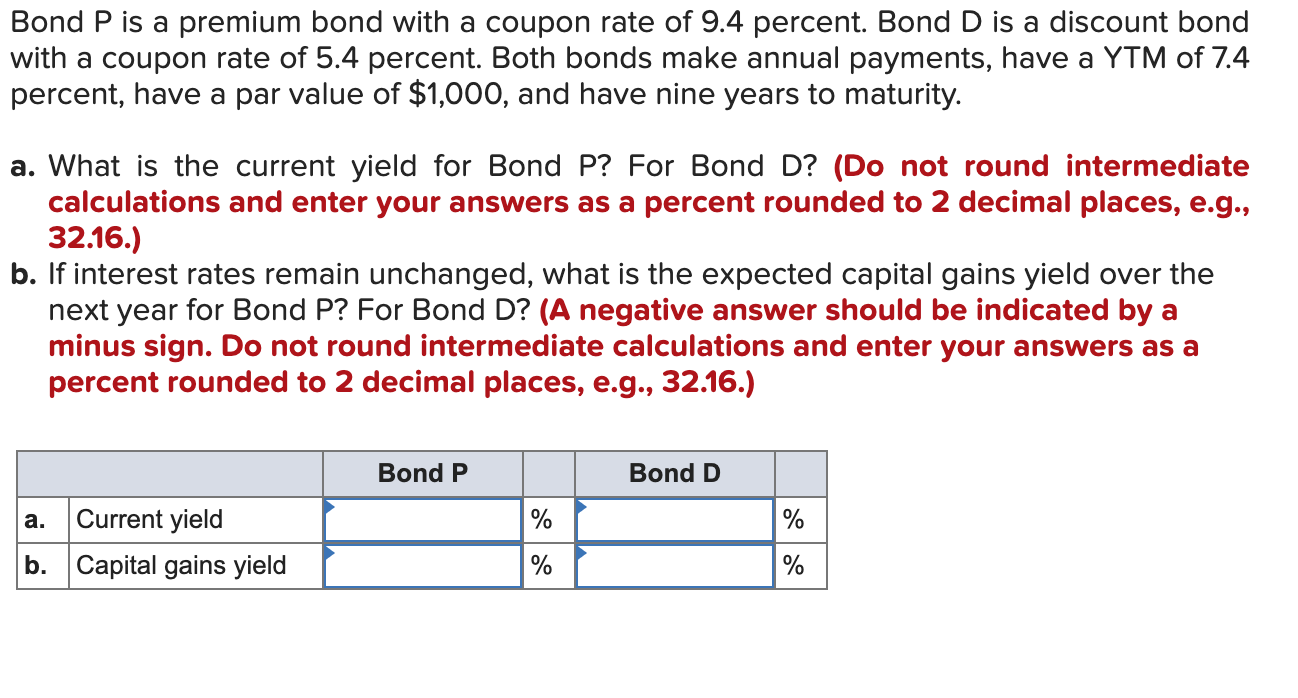

› knowledge › bond-yieldBond Yield: Formula and Percent Return Calculation Discount Bond: YTM > Coupon Rate; Par Bond: YTM = Coupon Rate; Premium Bond: YTM < Coupon Rate; For example, if the par value of a bond is $1,000 (“100”) and if the price of the bond is currently $900 (“90”), the security is trading at a discount, i.e. trading below its face value. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · Yield to Maturity vs. Coupon Rate: An Overview ... The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is ...

› ask › answersBond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

Coupon rate vs ytm

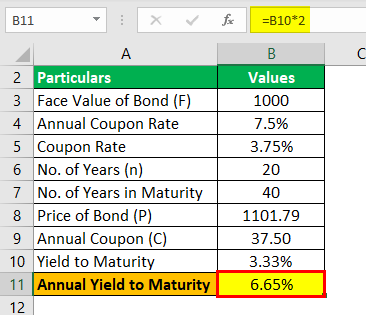

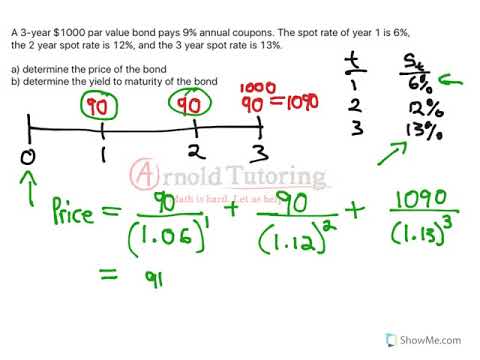

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Coupon rate vs. YTM and parity. If a bond's coupon rate is less than its YTM, then the bond is selling at a discount. If a bond's coupon rate is more than its YTM, then the bond is selling at a premium. If a bond's coupon rate is equal to its YTM, then the bond is selling at par. Variants of yield to maturity

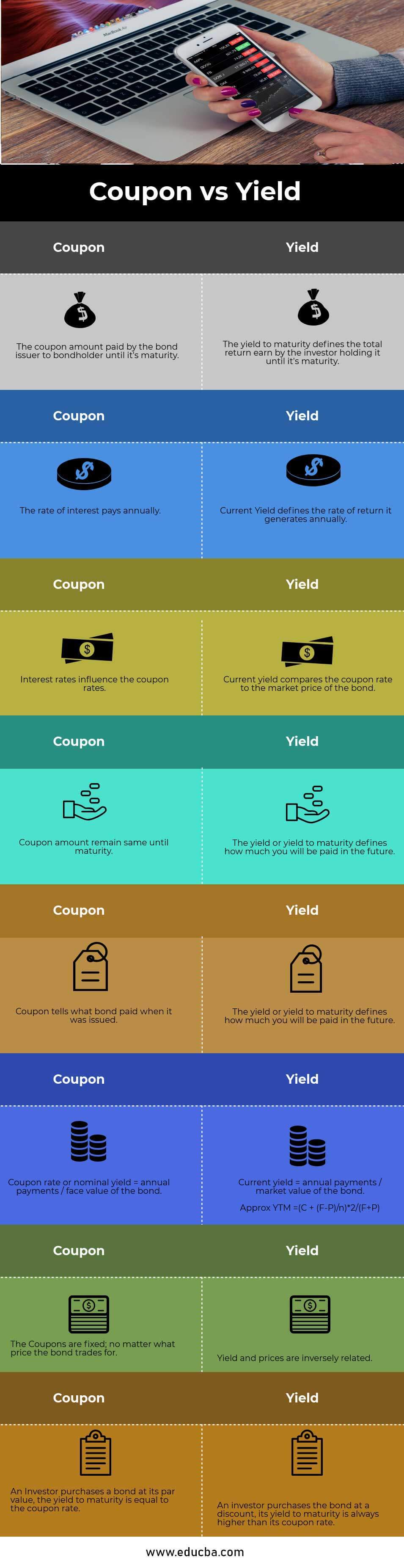

Coupon rate vs ytm. › coupon-vs-yieldCoupon vs Yield | Top 5 Differences (with Infographics) The coupon rate is fixed for the entire duration of the bond as both the numerator and the denominator for the calculation of the coupon rate do not change. The yield of a bond changes with the change in the price of the bond. Change in the interest rate in the economy by the central bank has no effect on the coupon rate of a bond. en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Coupon rate vs. YTM and parity. If a bond's coupon rate is less than its YTM, then the bond is selling at a discount. If a bond's coupon rate is more than its YTM, then the bond is selling at a premium. If a bond's coupon rate is equal to its YTM, then the bond is selling at par. Variants of yield to maturity home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data › terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Post a Comment for "42 coupon rate vs ytm"