41 present value of zero coupon bond calculator

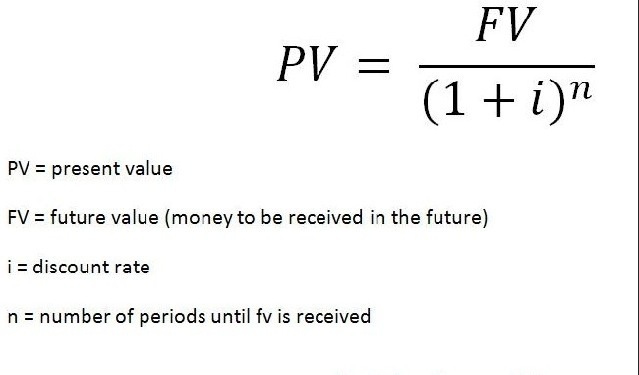

How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow 19/04/2021 · You can find present value tables on the Internet, or simply use an online present value calculator. If you use a table, you will locate the present value factor for a 4% discount rate for 5 years. That factor is .822. The present value of $100 is ($100 X .822 = $82.20). What Is Present Value in Finance, and How Is It Calculated? 13/06/2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ...

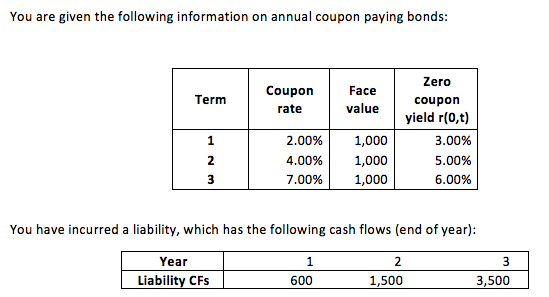

› calculators › bondpresentvalueBond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

Present value of zero coupon bond calculator

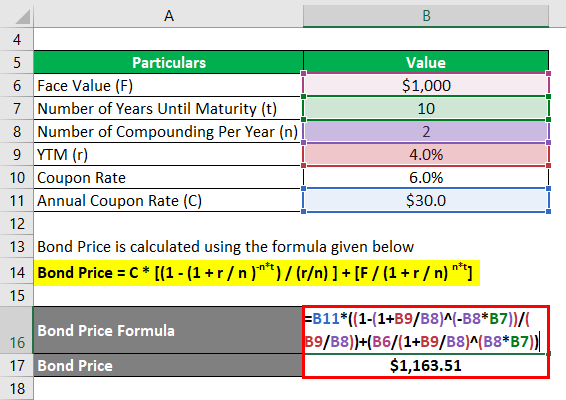

Bond Yield Calculator - CalculateStuff.com We know that the price of the bond is below the face value of the bond. This means that our first guess should be above our coupon rate because the cash inflows need to be discounted more than they would at the rate required to reach the face value. Since the coupon rate is 4.2%, let’s try 5%. When you plug in 5% to YTM in the equation, the ... Zero-Coupon Bonds: Characteristics and Calculation - Wall Street … To calculate the price of a zero-coupon bond – i.e. the present value (PV) – the first step is to find the bond’s future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. If the zero-coupon bond compounds semi-annually, the number of years until maturity must be ... Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

Present value of zero coupon bond calculator. dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value. Zero Coupon Bond Calculator – What is the Market Value? Zero Coupon Bond Calculator Outputs. Market Price ($): The market price of the bond, or its true value to fit the input criteria. What is a zero coupon bond? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the ... › terms › pWhat Is Present Value in Finance, and How Is It Calculated? Jun 13, 2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ... Future Value: Definition, Formula, How to Calculate ... - Investopedia 31/08/2022 · Future Value - FV: The future value (FV) is the value of a current asset at a specified date in the future based on an assumed rate of growth over time.

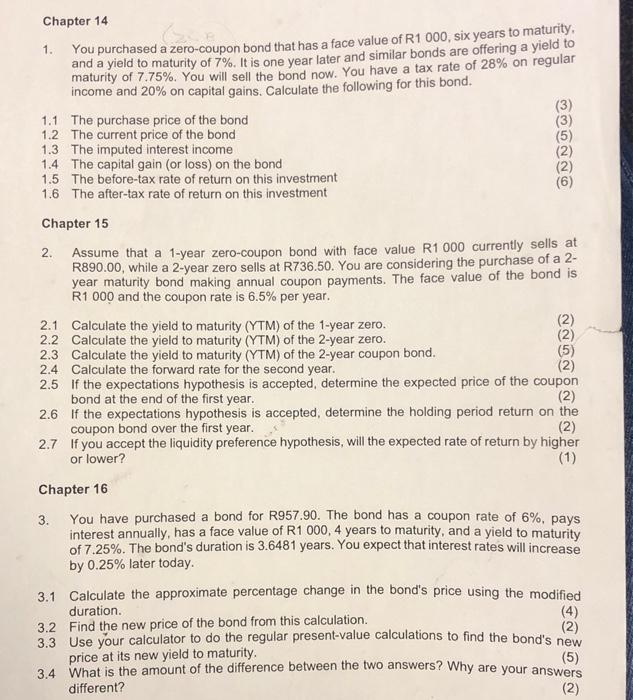

Zero Coupon Bond Value - Formula (with Calculator) - finance … The term discount bond is used to reference how it is sold originally at a discount from its face value instead of standard pricing with periodic dividend payments as seen otherwise. As shown in the formula, the value, and/or original price, of the zero coupon bond is discounted to present value. To find the zero coupon bond's value at its ... en.wikipedia.org › wiki › FinanceFinance - Wikipedia Determining the present value of these future values, "discounting", must be at the risk-appropriate discount rate, in turn, a major focus of finance-theory. Since the debate as to whether finance is an art or a science is still open, [29] there have been recent efforts to organize a list of unsolved problems in finance . Bond Yield to Maturity Calculator for Comparing Bonds Convertible Bonds – A convertible bond is just like any other fixed income security, with a par value, coupon, and set expiration date. However, a convertible bond has an additional clause in the contract that allows the investor to exchange it for shares in the issuing company at any time prior to its expiration date. So, if you hold a convertible bond with a par value of $1000, and it … dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator.

Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity. If the market rate is … stablebread.com › calculators › present-valuePresent Value Annuity Factor (PVAF) Calculator | StableBread Zero Coupon Bond Value Calculator; Debt and Loans. After-Tax Cost of Debt Calculator; ... Calculator; Present Value of Annuity Continuous Compounding (PVACC) Calculator; › Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F , 6% would be r , and t would be 5 years. After solving the equation, the original price or value would be $74.73. Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

Zero-Coupon Bonds: Characteristics and Calculation - Wall Street … To calculate the price of a zero-coupon bond – i.e. the present value (PV) – the first step is to find the bond’s future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. If the zero-coupon bond compounds semi-annually, the number of years until maturity must be ...

Bond Yield Calculator - CalculateStuff.com We know that the price of the bond is below the face value of the bond. This means that our first guess should be above our coupon rate because the cash inflows need to be discounted more than they would at the rate required to reach the face value. Since the coupon rate is 4.2%, let’s try 5%. When you plug in 5% to YTM in the equation, the ...

Post a Comment for "41 present value of zero coupon bond calculator"