38 present value formula coupon bond

Bond Valuation: Calculation, Definition, Formula, and Example Present value of semi-annual payments = 25 / (1.015) 1 + 25 / (1.015) 2 + 25 / (1.015) 3 + 25 / (1.015) 4 = 96.36 Present value of face value = 1000 / (1.015) 4 = 942.18 Therefore, the value of the... Bond Price Calculator | Formula | Chart It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A ...

Solved 3. Calculate the market value (in dollars) of the | Chegg.com 3. Calculate the market value (in dollars) of the following bond using the present value formula. a. Maturity is exactly four years from today. b. The Par Value is $1, 000 c. The Coupon Rate is 3.50%. Coupon Payments are made semiannually. d. The current YTM is 3.80%. 4. Referencing your answer to Problems #3, what is the market value (in $) of ...

Present value formula coupon bond

Coupon Payment Calculator The formula to calculate the current yield on a bond is: Current yield = annual coupon payments/market value of the bond Except when you're buying a bond at its face value, you should be concerned about its current yield when evaluating its yield to maturity or yield to call. Types of coupon payments Excel formula: Bond valuation example | Exceljet =- PV( C6 / C8, C7 * C8, C5 / C8 * C4, C4) The arguments provided to PV are as follows: rate - C6/C8 = 8%/2 = 4% nper - C7*C8 = 3*2 = 6 pmt - C5/C8*C4 = 7%/2*1000 = 35 fv - 1000 The PV function returns -973.79. To get positive dollars, we use a negative sign before the PV function to get final result of $973.79 Between coupon payment dates Bond Formulas - thisMatter.com Formula for the Effective Interest Rate of a Discounted Bond; i = (Future Value/Present Value) 1/n - 1: i = interest rate per compounding period n = number of compounding periods FV = Future Value PV = Present Value

Present value formula coupon bond. Coupon Payment | Definition, Formula, Calculator & Example The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2]. This means that Walmart Stores Inc. pays $32.5 after each six months to bondholders. Please note that coupon payments are calculated based on the stated interest rate (also called nominal yield) rather than the yield to maturity or the current yield. Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping Suppose the discount rate was 7%, the face value of the bond of 1,000 is received in 3 years time at the maturity date, and the present value is calculated using the zero coupon bond formula which is the same as the present value of a lump sum formula. The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond ... Coupon Bond Formula | Examples with Excel Template Coupon Bond = $25 * [1 - (1 + 4.5%/2)-16] + [$1000 / (1 + 4.5%/2) 16; Coupon Bond = $1,033; Therefore, the current market price of each coupon bond is $1,033, which means it is currently traded at a premium (current market price higher than par value). Explanation. The formula for coupon bond can be derived by using the following steps:

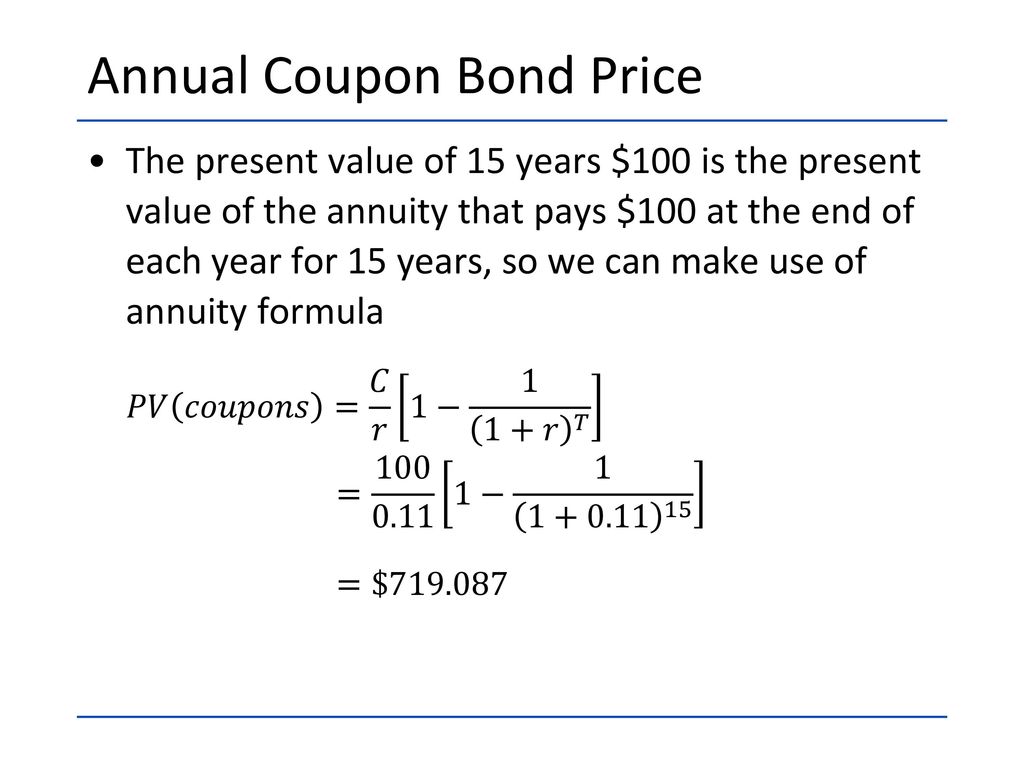

How to Calculate the Present Value of a Bond | Pocketsense The final period usually coincides with the maturity date. Required Rate (Rate): the interest rate per coupon period demanded by investors. The formula for determining the value of a bond uses each of the four factors, and is expressed as: Bond Present Value = Pmt/ (1+Rate) + Pmt/ (1+Rate) 2 + ... +Pmt/ (1+Rate) Nper + Fv/ (1+Rate) Nper. How to calculate the present value of a bond - AccountingTools Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor. Go to a present value of an ordinary annuity table and locate the present value of the stream of interest payments, using the 8% market rate. This amount is 3.9927. How to Calculate PV of a Different Bond Type With Excel - Investopedia The bond provides coupons annually and pays a coupon amount of 0.025 x 1000= $25. Notice here that "Pmt" = $25 in the Function Arguments Box. The present value of such a bond results in an outflow... Bond Valuation | Meaning, Methods, Present Value, Example | eFM Thus, Present Value of Bond = 9.25+8.57+7.94+80.85 = US$ 106.62 There are other approaches to bond valuation, such as the relative price approach, arbitrage-free pricing approach, and traditional approach. But this present value approach is the most widely used approach to bond valuation. Why Bond Valuation?

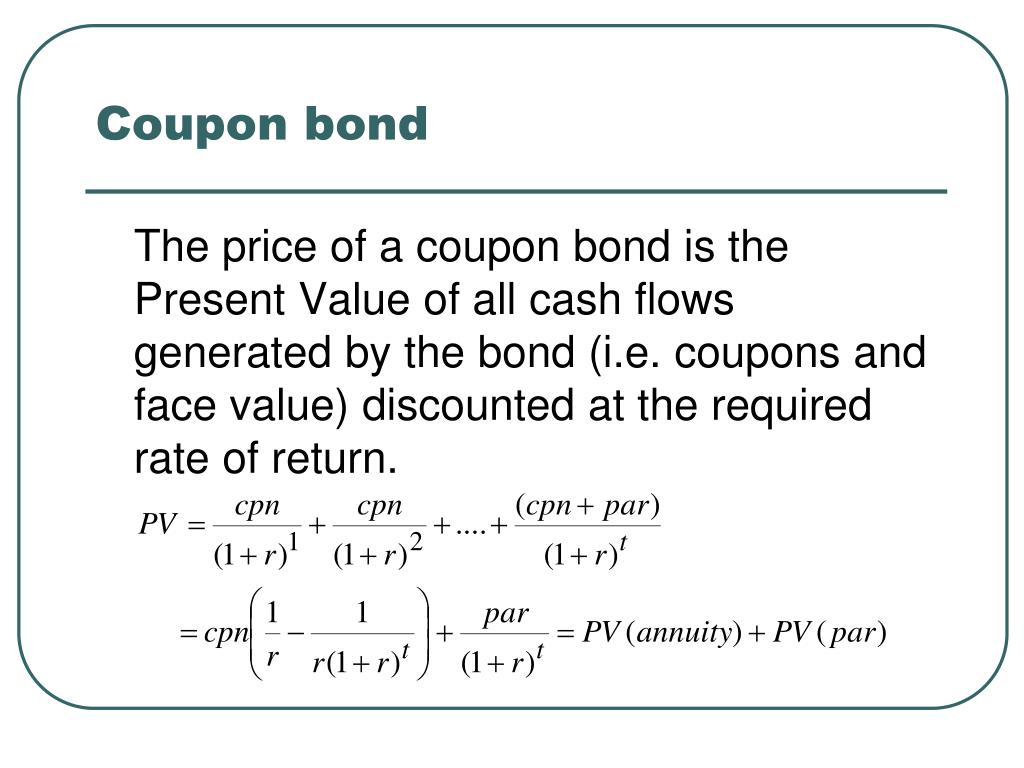

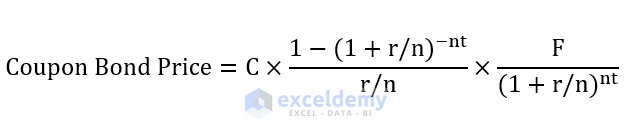

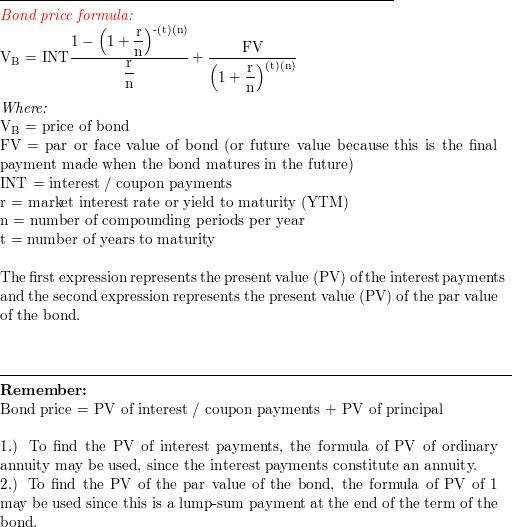

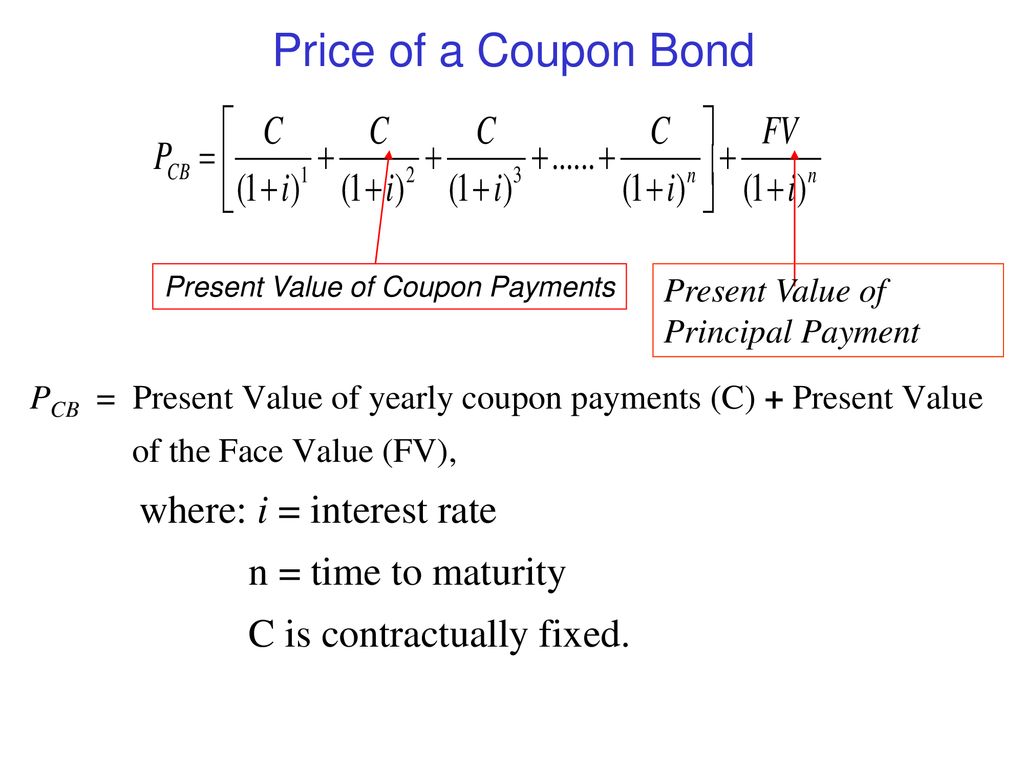

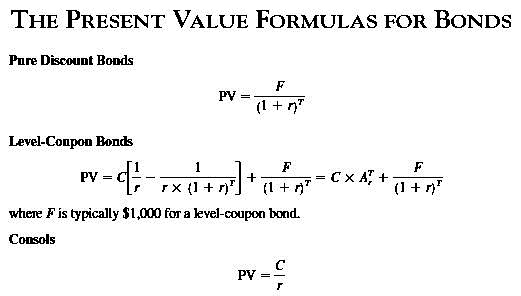

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] Coupon Bond - Guide, Examples, How Coupon Bonds Work Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate. i = Interest rate. n = number of payments Zero-Coupon Bond Primer: What are Zero-Coupon Bonds? - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes Bond Formula | How to Calculate a Bond | Examples with Excel Template The PV is calculated by discounting the cash flow using yield to maturity (YTM). Mathematically, the formula for coupon bond is represented as, Coupon Bond Price = C * [ (1- (1 + r / n )-n*t ) / (r/n) ] + [F / (1 + r / n) n*t] where, C = Annual Coupon Payment. F = Par Value at Maturity.

Coupon Rate Formula | Step by Step Calculation (with Examples) Do the Calculation of the coupon rate of the bond. Annual Coupon Payment Annual coupon payment = 2 * Half-yearly coupon payment = 2 * $25 = $50 Therefore, the calculation of the coupon rate of the bond is as follows - Coupon Rate of the Bond will be - Example #2 Let us take another example of bond security with unequal periodic coupon payments.

Bond Present Value Calculator The calculator, uses the following formulas to compute the present value of a bond: Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ^ Number Payments Present Value of Interest Payments = Payment Value * (1 - (Market Rate / 100) ^ -Number Payments) / Number Payments)

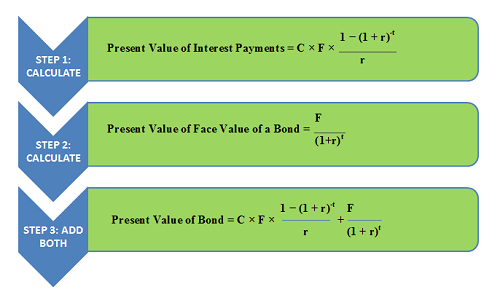

Bond Valuation Overview (With Formulas and Examples) The formula adds the present value of the expected cash flows to the bond's face value's present value. Below is the following formula for our valuation. ... Value of bond = present value of coupon payments + present value of face value Value of bond = $92.93 + $888.49 Value of bond = $981.42. A natural question one would ask is, what does ...

Bond Valuation: Formula, Steps & Examples - Study.com A bond's present value (price) is determined by the following formula: Price = {Coupon_1}/ { (1+r)^1} + {Coupon_2}/ { (1+r)^2} + ... + {Coupon_n}/ { (1+r)^n} + {Face Value}/ { (1+r)^n} For example,...

How to Calculate Present Value of a Bond - Pediaa.Com Step 1: Calculate Present Value of the Interest Payments. Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond. F = Face value of the bond. R = Market. t = Number of time periods occurring until the maturity of the bond.

3 Present Value of bond formula - YouTube 3 Present Value of bond formula. 12,870 views • Jan 4, 2018. 12,870 views Jan 4, 2018 Description … ...more ...more ...

Calculating the Present Value of a 9% Bond in an 8% Market Let's use the following formula to compute the present value of the maturity amount only of the bond described above. The maturity amount, which occurs at the end of the 10th six-month period, is represented by "FV" .The present value of $67,600 tells us that an investor requiring an 8% per year return compounded semiannually would be willing to invest $67,600 in return for a single receipt of ...

Bond Price | Definition, Formula and Example - XPLAIND.com Since the interest is paid semiannually the bond coupon rate per period is 4.5% (= 9% ÷ 2), the market interest rate is 4% (= 8% ÷ 2) and number of coupon payments (time periods) are 20 (= 2 × 10). Hence, the price of the bond is calculated as the present value of all future cash flows as shown below:

How to Figure Out the Present Value of a Bond - dummies Use the present value factors to calculate the present value of each amount in dollars. The present value of the bond is $100,000 x 0.65873 = $65,873. The present value of the interest payments is $7,000 x 3.10245 = $21,717, with rounding. Add the present value of the two cash flows to determine the total present value of the bond.

Bond valuation - Wikipedia Below is the formula for calculating a bond's price, which uses the basic present value (PV) formula for a given discount rate. [3] This formula assumes that a coupon payment has just been made; see below for adjustments on other dates. where: F = face value i F = contractual interest rate C = F * i F = coupon payment (periodic interest payment)

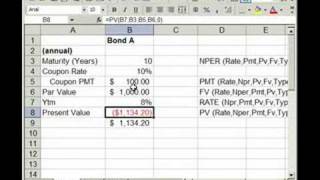

How to Calculate Bond Price in Excel (4 Simple Ways) 🔄 Semi-Annual Coupon Bond In cell K10 insert the following formula. =PV (K8/2,K7,K5*K9/2,K5) In the formula, rate = K8/2 (as it's a semi-annual bond price), nper = K7, pmt = K5*K9/2, [fv] = K5. After executing the respective formulas, you can find different bond prices as depicted in the latter screenshot.

Bond Formulas - thisMatter.com Formula for the Effective Interest Rate of a Discounted Bond; i = (Future Value/Present Value) 1/n - 1: i = interest rate per compounding period n = number of compounding periods FV = Future Value PV = Present Value

Excel formula: Bond valuation example | Exceljet =- PV( C6 / C8, C7 * C8, C5 / C8 * C4, C4) The arguments provided to PV are as follows: rate - C6/C8 = 8%/2 = 4% nper - C7*C8 = 3*2 = 6 pmt - C5/C8*C4 = 7%/2*1000 = 35 fv - 1000 The PV function returns -973.79. To get positive dollars, we use a negative sign before the PV function to get final result of $973.79 Between coupon payment dates

Coupon Payment Calculator The formula to calculate the current yield on a bond is: Current yield = annual coupon payments/market value of the bond Except when you're buying a bond at its face value, you should be concerned about its current yield when evaluating its yield to maturity or yield to call. Types of coupon payments

Post a Comment for "38 present value formula coupon bond"