44 ytm for coupon bond

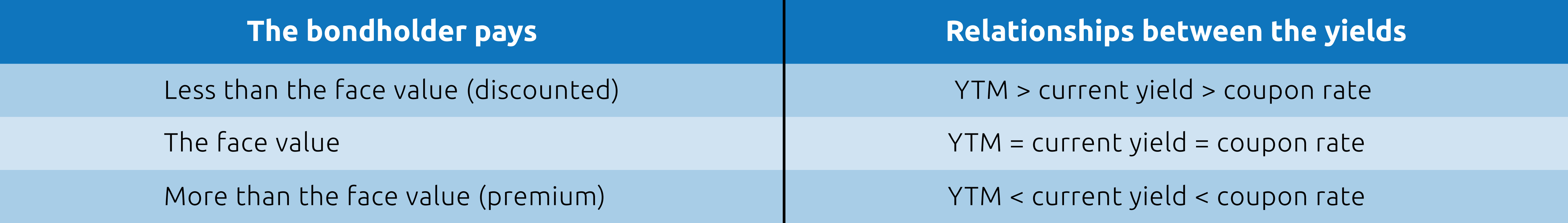

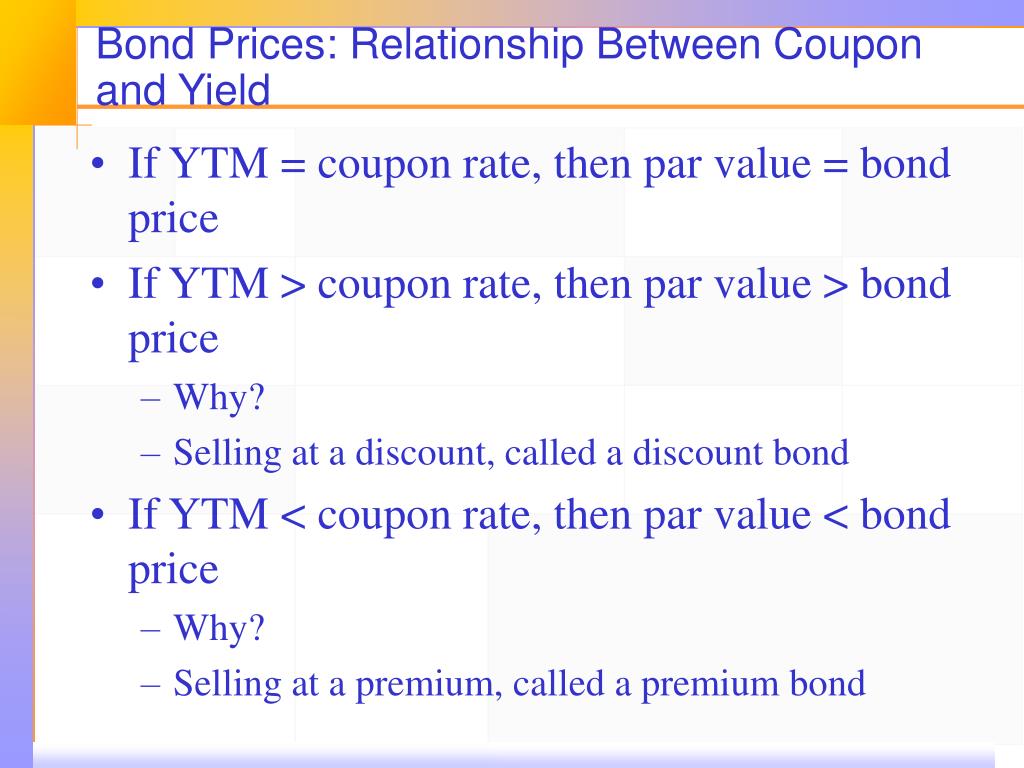

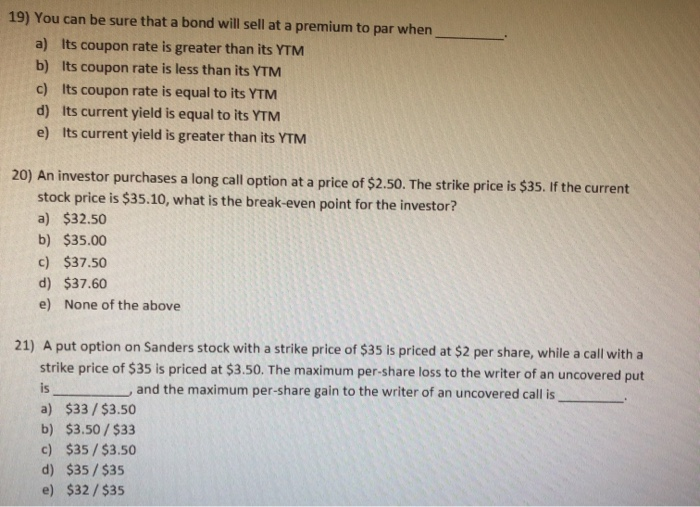

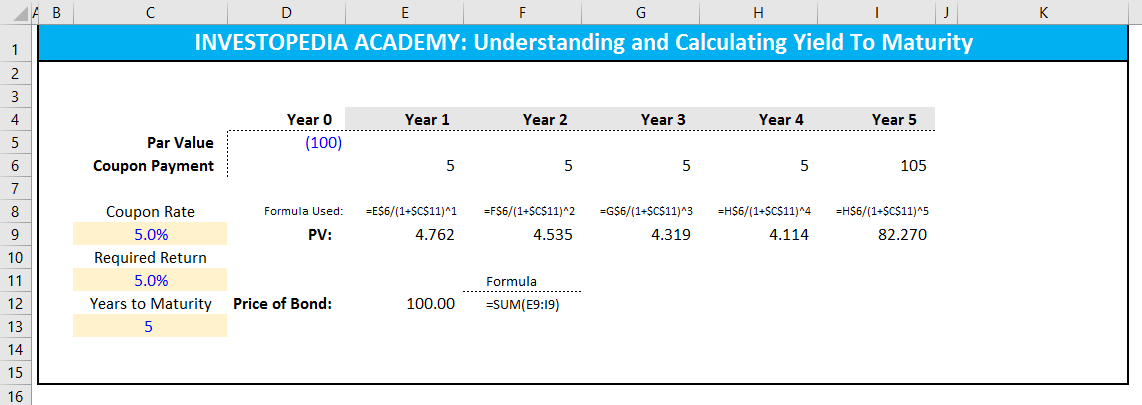

Yield to Maturity (YTM) - Meaning, Formula and Examples The formula of current yield: Coupon rate / Purchase price. Naturally, if the bond purchase price is equal to the face value, the current yield will be equal to the coupon rate. Current Yield = 160/2,000 = 0.08 or 8%. Let's say the purchase price falls to 1,800. Current Yield = 160/1,800= 0.089 or 8.9%. The current Yield rises if the purchase ... Yield to Maturity | Formula, Examples, Conclusion, Calculator The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments r = discount rate (the yield to maturity) F = Face value of the bond n = number of coupon payments

Yield to Maturity (YTM) - Definition, Formula, Calculations Use the below-given data for calculation of YTM We can use the above formula to calculate approximate yield to maturity. Coupons on the bond will be $1,000 * 8%, which is $80. Yield to Maturity (Approx) = (80 + (1000 - 94) / 12 ) / ( (1000 + 940) / 2) YTM will be - Example #2 FANNIE MAE is one of the famous brands that are trading in the US market.

/GettyImages-810720992-f4dcb14dc2674174a84be79d0d538f85.jpg)

Ytm for coupon bond

How to Calculate Yield to Maturity: 9 Steps (with Pictures) The coupon payment is $100 ( ). The face value is $1,000, and the price is $920. The number of years to maturity is 10. [2] Use the formula: Using this calculation, you arrive at an approximate yield to maturity of 11.25 percent. 3 Check the validity of your calculation. Plug the yield to maturity back into the formula to solve for P, the price. Yield to Maturity - Approximate Formula (with Calculator) The price of a bond is $920 with a face value of $1000 which is the face value of many bonds. Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity. This example using the approximate formula would be. After solving this equation, the estimated yield to maturity is 11.25%. Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

Ytm for coupon bond. Yield to Maturity (YTM) Definition & Example | InvestingAnswers The bond will mature in 6 years and the coupon rate is 5%. To determine the YTM, we'll use the formula mentioned above: YTM = t√$1,500/$1,000 - 1 The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don't have recurring interest payments, they don't have a coupon rate. bond - Why does the YTM equal the coupon rate at par? - Quantitative ... I know the YTM of a coupon bond is the interest rate i which verifies P = C ( 1 + i) + C ( 1 + i) 2 +... + C ( 1 + i) n + F ( 1 + i) n where P is price, C is the coupon payment and F is face value. I don't understand why i = C / F when P = F. Yield to Maturity (YTM): Formula and Excel Calculator Annual Coupon (C) = 3.0% × $1,000 = $30 Yield to Maturity (YTM) Example Calculation With all required inputs complete, we can calculate the semi-annual yield to maturity (YTM). Semi-Annual Yield-to-Maturity (YTM) = [$30 + ($1,000 - $1,050) / 20] / [ ($1,000 + $1,050) / 2] Semi-Annual YTM = 2.7% Calculate YTM on deferred coupon bonds using texas instruments Stellar Corp. recently issued $100 par value deferred coupon bonds, which will make no coupon payments in the next four years. Regular annual coupon payments at a rate of 8% will then be made until the bonds mature at the end of 10 years. If the bonds are currently priced at $87.00, their yield to maturity is closest to: 6% = Answer

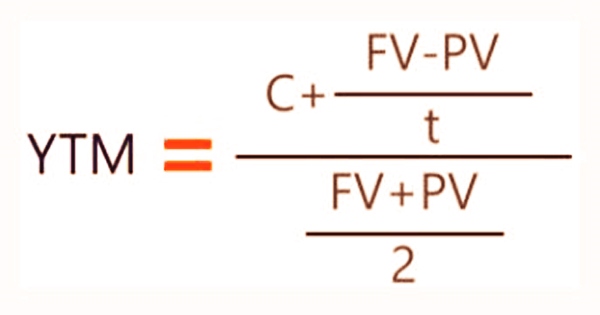

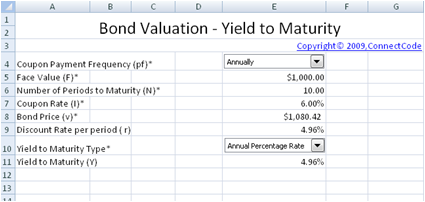

Yield to maturity calculator Formula to calculate yield to maturity. C - Interest/coupon payment. FV - Face Value of the bond. PV - Present value of the bond. t - Number of years it takes the bond to reach maturity. Example: Assume that there is a bond on the market priced at $800 and that the bond comes with a face value of $900. ... Understanding a bond's yield ... Difference Between YTM and Coupon rates Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author. How to calculate yield to maturity in Excel (Free Excel Template) RATE (nper, pmt, pv, [fv], [type], [guess]) Here, Nper = Total number of periods of the bond maturity. The years to maturity of the bond is 5 years. But coupons per year are 2. So, nper is 5 x 2 = 10. Pmt = The payment made in every period. It cannot change over the life of the bond. The coupon rate is 6%. Yield to Maturity Calculator | Calculate YTM The YTM can be thought of as the rate of return on a bond. If you hold the bond to maturity after buying it in the market and are able to reinvest the coupons at the YTM, the YTM will be the internal rate of return (IRR) of your bond investments.

Yield to Maturity Calculator | Good Calculators r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to Maturity? The Returns on a Bond - YTM - The Fixed Income The bond price is calculated from the yield to maturity of the bond, as that is the effective return on the bond. The formula, YTM = C1/ (1+YTM)^1 + C2/ (1+YTM)^2 + C3/ (1+YTM)^3 + ……+ Cn/ (1+YTM)^n + Maturity value/ (1+YTM)^n Here 'C' is the coupon or each installment of interest received, Yield to Maturity (YTM) - Overview, Formula, and Importance The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

Yield to Maturity (YTM) Definition - Investopedia Because YTM is the interest ratean investor would earn by reinvesting every coupon payment from the bond at a constant interest rate until the bond's maturity date, the present value of all the...

How to Calculate the Price of Coupon Bond? - WallStreetMojo Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond,

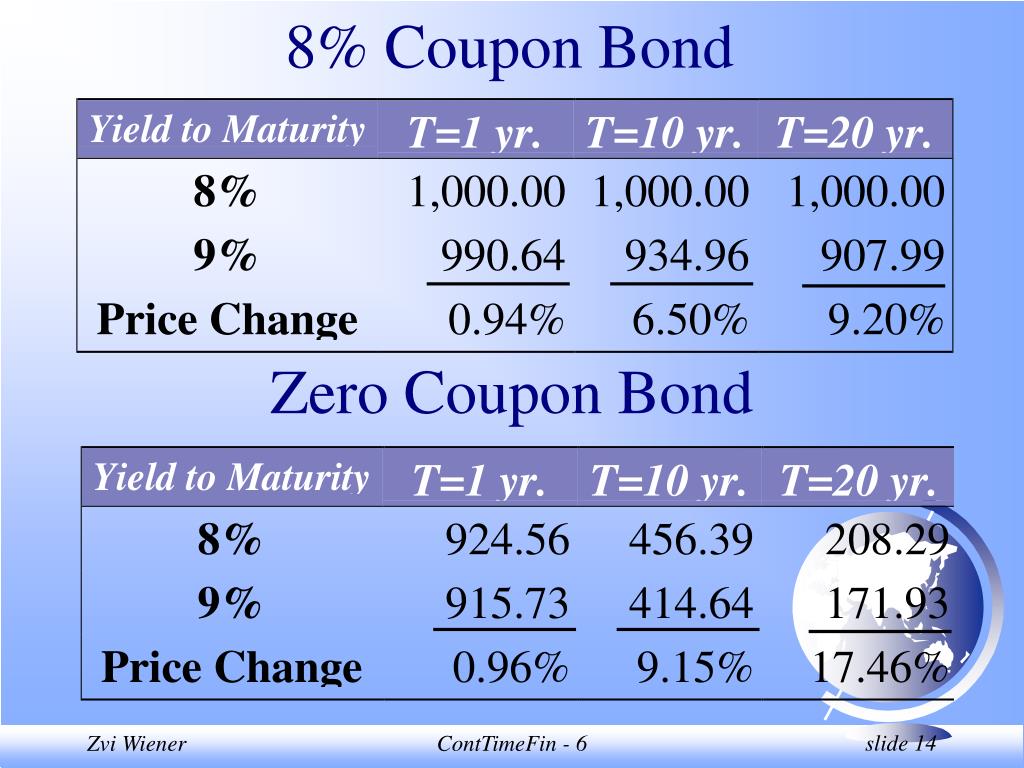

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

Important Differences Between Coupon and Yield to Maturity The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

Solved What is the YTM of a twenty-year zero coupon bond | Chegg.com Expert Answer 5.54% Face value of bond is $ 1000 which is paid at the end of maturit … View the full answer Transcribed image text: What is the YTM of a twenty-year zero coupon bond which is currently selling for $340? 5.85% 5.75% 5.54% 5.68% Previous question Next question

Yield to Maturity (YTM) - Meaning, Formula & Calculation Using the YTM formula, the required yield to maturity can be determined. 700 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 1000/ (1+YTM)^2 The Yield to Maturity (YTM) of the bond is 24.781% After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM.

Find Bond YTM - annual vs semiannual coupons - YouTube About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How YouTube works Test new features Press Copyright Contact us Creators ...

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

Yield to Maturity - Approximate Formula (with Calculator) The price of a bond is $920 with a face value of $1000 which is the face value of many bonds. Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity. This example using the approximate formula would be. After solving this equation, the estimated yield to maturity is 11.25%.

How to Calculate Yield to Maturity: 9 Steps (with Pictures) The coupon payment is $100 ( ). The face value is $1,000, and the price is $920. The number of years to maturity is 10. [2] Use the formula: Using this calculation, you arrive at an approximate yield to maturity of 11.25 percent. 3 Check the validity of your calculation. Plug the yield to maturity back into the formula to solve for P, the price.

Post a Comment for "44 ytm for coupon bond"