41 coupon rate 10 year treasury

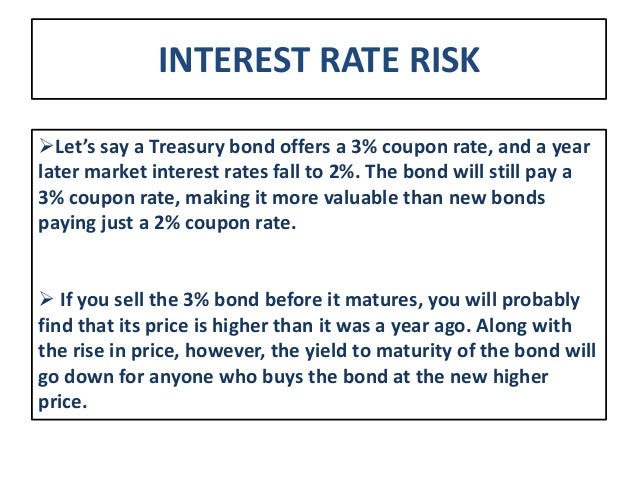

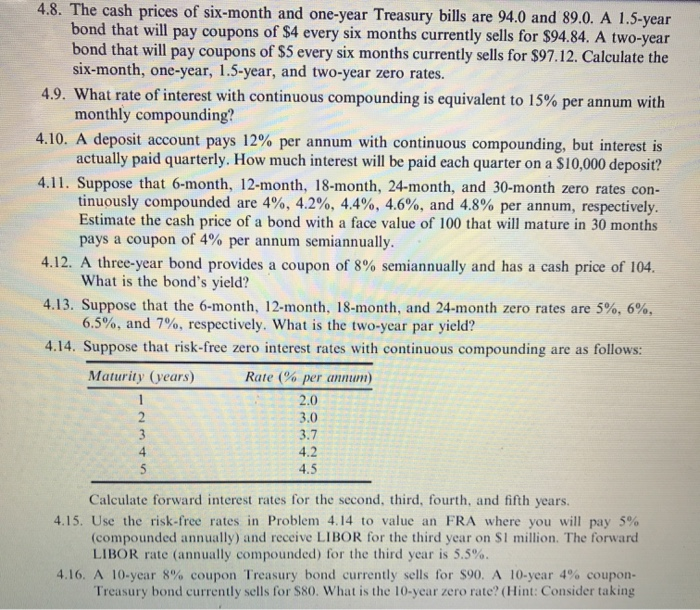

Yield Calculation for a 10-Year Treasury Note | Sapling However, if you buy a bond for $900, you'll receive your annual four percent coupon plus an additional $100 at maturity. The formula for the yield to maturity calculation is: Where: P = price of the bond. n = number of periods. C = coupon payment. r = required rate of return on this investment. F = maturity value. 10-Year US Treasury Note - Corporate Finance Institute When setting the Federal Funds Rate, the Federal Reserve takes into account the current 10-year Treasury rate of return. The yield on the 10-Year Note is the most commonly used Risk-Free Rate for calculating a company's Weighted Average Cost of Capital (WACC) and performing Discounted Cash Flow (DCF) Analysis. Investing in Treasury Notes

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value ...

Coupon rate 10 year treasury

US 10 year Treasury Bond, chart, prices - FT.com US 10 year Treasury, interest rates, bond rates, bond rate. Subscribe; Sign In; Menu Search. Financial Times. myFT. Search the FT Search Search the ... US 10 year Treasury. Yield 2.75; Today's Change-0.027 / -0.97%; 1 Year change +114.37%; Data delayed at least 20 minutes, as of Jul 22 2022 22:05 BST. ... Treasury yields edge higher, with 2-year rate back above 3%, ahead of ... The yield on the 10-year Treasury TMUBMUSD10Y, 2.761% advanced to 2.819% versus 2.781% on Friday. The yield on the 30-year Treasury TMUBMUSD30Y, 2.987% rose to 3.048% from 2.996% Friday afternoon. TMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch Breaking 10-year Treasury yield hits New York session low of 2.94% as traders assess signs of slowing U.S. economy and reports on Biden Jul. 21, 2022 at 10:36 a.m. ET by Vivien Lou Chen Treasury...

Coupon rate 10 year treasury. Individual - Treasury Notes: Rates & Terms Treasury Notes: Rates & Terms Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. Price and Interest The price and interest rate of a Note are determined at auction. The price may be greater than, less than, or equal to the Note's par amount. (See rates in recent auctions .) 10 Year Treasury Rate - YCharts Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 2.77%, compared to 2.91% the previous market day and 1.27% last year. This is lower than the long term average of 4.27%. Stats Individual - Treasury Bonds: Rates & Terms Interest Coupon Rate Price Explanation; Discount (price below par) 30-year bond Issue Date: 8/15/2005: 4.35%: 4.25%: 98.333317: ... For example, you buy a 30-Year Treasury bond issued February 15, 2006 and maturing February 15, 2036. If February 15, 2006 fell on a Saturday, Treasury would issue the bond on the next business day, Monday February ... US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News Price Day Low 99.75 Coupon 2.875% Maturity 2032-05-15 Latest On U.S. 10 Year Treasury Treasury yields extend retreat ahead of rate hike July 22, 2022CNBC.com What to watch in the markets in the...

Treasury Return Calculator, With Coupon Reinvestment - DQYDJ A 10 Year Treasury note pays a coupon every 6 months. The calculator assumes bonds are bought at face value with no transaction fees and a tax rate of 0%. Market Yield on US Treasury Securities at 10-Year Constant ... Categories > Money, Banking, & Finance > Interest Rates > Treasury Constant Maturity. Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an ... Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis [DGS10 ... What Is a 10-Year Treasury Note and How Does It Work? What Is the Current Yield on the 10-Year Treasury Note? As with interest rates, 10-year Treasury note yields are fluid and change often. As of early April 2020, the yield on a 10-year T-note was about 0.6%. The yield changes with the dynamics of the economic climate and is used as a benchmark for other interest rates. Building Wealth How Is the Interest Rate on a Treasury Bond Determined? If an investor purchases that same $10,000 bond for $9,500, then the rate of investment return isn't 5% - it's actually 5.26%. This is calculated by the annual coupon payment ($500) divided by the...

10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends 10 Year Treasury Rate - 54 Year Historical Chart. Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of July 12, 2022 is 2.96%. Show Recessions. Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example. Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63%. The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate. US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months. 10-Year T-Note Overview - CME Group Spread 10-Year Treasury futures versus other benchmark tenors to express a view on the shape of the yield curve curve, adjust portfolio duration, and unlock cross-margin savings. 2-Year and 10-Year Trade the 2s10s spread, one of the most-watched economic indicators, with up to 50% margin offsets View 2Y contract specs 5-Year and 10-Year

How the 10-Year Treasury Note Guides All Other Interest Rates 0.06% on the one-month Treasury bill 0.06% on the three-month bill 0.73% on the two-year Treasury note 1.52% on the 10-year note 1.93% on the 30-year Treasury bond 12 Frequently Asked Questions (FAQs) How can I buy a 10-year Treasury note? You can buy Treasury notes on the TreasuryDirect website in $100 increments.

United States 10-Year Bond Yield - Investing.com United States 10-Year Bond Yield ; Coupon2.875 ; Day's Range2.707 - 2.805 ; Price Open100.63 ; Maturity Date15 MAY 2032 ; 52 wk Range1.127 - 3.498.

Interest Rate Statistics | U.S. Department of the Treasury At that time Treasury released 1 year of historical data. View the Daily Treasury Par Real Yield Curve Rates · Daily Treasury Bill Rates. These rates are ...

A new 10-year TIPS will be auctioned Thursday. Anyone interested? On the purchase price: The coupon rate will be 0.125% and the real yield will probably be around -1.03%, leaving a 1.15% shortfall to create the premium price. We've never had a 10-year TIPS with a negative yield so low. On Jan 21, the yield was -0.987%, resulting in an adjusted price of $111.64.

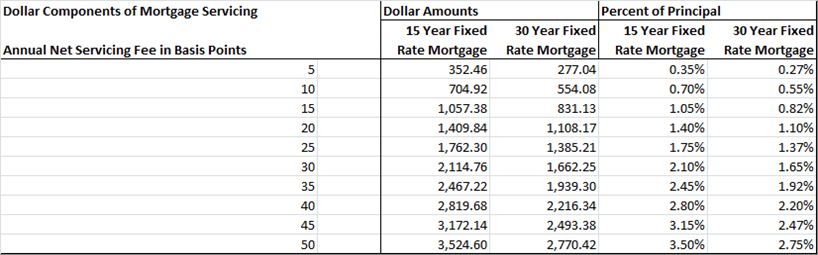

Coupon Interest and Yield for eTBs - australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months.

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month

Coupon Rate Calculator | Solution Step by Step 🥇 The coupon rate is the annual interest rate that a bond pays. That may seem obvious, but it's important to remember: The coupon rate doesn't specify how much you'll receive each month, or even on the same day every year. ... So when someone says "the 10-year Treasury has a 3% coupon," what they really mean is that if you buy one of ...

Solved Problem 2-24 Which security should sell at a greater - Chegg A 10-year Treasury bond with a 5% coupon rate or a 10-year T-bond with a 6% coupon. multiple choice 1. A 10-year Treasury bond with a 5% coupon rate. A 10-year T-bond with a 6% coupon. b. A three-month expiration call option with an exercise price of $40 or a three-month call on the same stock with an exercise price of $35. multiple choice 2

Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2018-Present. TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2012 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2018-Present. TNC Treasury Yield Curve Par Yields, Monthly Average: 1976-Present

10-Year Treasury Note Definition - Investopedia The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. A 10-year Treasury note pays interest at a fixed rate once...

United States Government Bond 10Y - 1912-2021 Historical The yield on the US Treasury 10-year note slipped below the 2.8% mark, a level not seen in two months, as investors rushed to safe-haven assets amid ...

TMUBMUSD10Y | U.S. 10 Year Treasury Note Overview Coupon Rate 2.875% ; Maturity May 15, 2032 ; 5 Day. -22.53 ; 1 Month. -28.98 ; 3 Month. -2.80.

TMUBMUSD10Y | U.S. 10 Year Treasury Note Price & News - WSJ TMUBMUSD10Y | View the latest U.S. 10 Year Treasury Note news, historical stock charts, analyst ratings, financials, and today's stock price from WSJ.

Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Graph and download economic data for Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) from 1990-01-02 to 2022-07-15 about 10-year, bonds, yield, interest rate, interest, rate, and USA. ... Kim and Wright (2005) produced this data by fitting a simple three-factor arbitrage-free term structure model to U.S. Treasury yields since 1990, in ...

TMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch Breaking 10-year Treasury yield hits New York session low of 2.94% as traders assess signs of slowing U.S. economy and reports on Biden Jul. 21, 2022 at 10:36 a.m. ET by Vivien Lou Chen Treasury...

Treasury yields edge higher, with 2-year rate back above 3%, ahead of ... The yield on the 10-year Treasury TMUBMUSD10Y, 2.761% advanced to 2.819% versus 2.781% on Friday. The yield on the 30-year Treasury TMUBMUSD30Y, 2.987% rose to 3.048% from 2.996% Friday afternoon.

Post a Comment for "41 coupon rate 10 year treasury"