44 are treasury bills zero coupon bonds

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. Zero-coupon bond - Wikipedia Examples of zero-coupon bonds include US Treasury bills, US savings bonds, long-term zero-coupon bonds, and any type of coupon bond that has been stripped of its coupons. Zero coupon and deep discount bonds are terms that are used interchangeably.

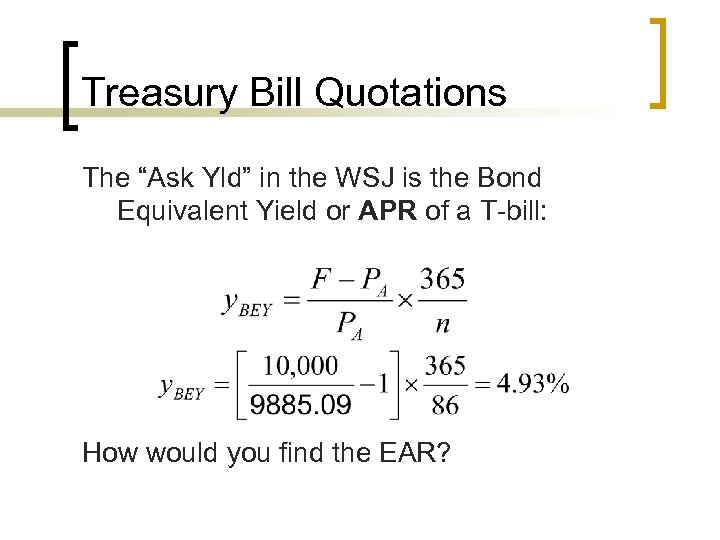

What's the difference between a zero-coupon bond and a Treasury bill? T-bills are also called as zero coupon bond, which is issued at discount. T bills are short term instruments issued within one year. 91 days, 182 days, 364 days are the examples of maturity period. T-bills are issued by goverment of any country. One point to remember

Are treasury bills zero coupon bonds

Treasury Bills - Guide to Understanding How T-Bills Work T-bills, T-notes, and T-bonds are fixed-income investments issued by the US Department of the Treasury when the government needs to borrow money. They are all commonly referred to as "Treasuries." T-Bills Treasury bills have a maturity of one year or less, and they do not pay interest before the expiry of the maturity period. Zero-Coupon Bond - Definition, How It Works, Formula It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. › investing-firm › treasuryTreasury Brokers: Bonds, Bills, Notes Buying Cost in 2022 Marked as TIPS, these bonds adjust up or down as the consumer price index changes. The minimum order at Schwab for Treasuries is $1,000. The broker does not charge any commissions for Treasury bonds, notes, and bills on the secondary or primary market. Zero-coupon Treasuries and STRIPS are $1 each, with a $10 minimum and a $250 maximum.

Are treasury bills zero coupon bonds. › terms › tTreasury Bills (T-Bills) Definition - Investopedia T-bills do not pay regular interest payments as with a coupon bond, but a T-Bill does include interest,reflected in the amount it pays when it matures. T-Bill Tax Considerations The interest income... › treasury-bills-vs-bondsTreasury Bills vs Bonds | Top 5 Best Differences (With ... Let us Discussed some of the major differences between Treasury Bills vs Bonds: Treasury bills are short term money market instruments whereas Treasury Bonds are long term capital market instruments. Treasury bills are issued at a discounted price whereas Treasury Bonds pay interest every six months to holders of a bond. Treasury bills mature ... B treasury bills are zero coupon bonds c zero coupon B) Treasury bills are zero -coupon bonds. C) Zero -coupon bonds always trade at a discount. D) The yield to maturity is typically stated as an annual rate by multiplying the calculated YTM by the number of coupon payment per year, thereby converting it to an APR. Investing in Treasury Bills: The Safest Investment in 2022 A Treasury bill is any bond issued with a maturity of one year or less. Treasury notes have maturities from two to 10 years. And Treasury bonds mature 20 years or later. (For simplicity, this article refers to all three as "Treasury bills" or "T-bills" or simply "Treasuries.") Treasury bills are seen as the safest bonds in the world ...

Can you lose money on Treasury notes? - Note Brokering Treasury bills are not like coupon bonds that pay interest in accruals. What are Treasury bills example? Treasury bills are zero-coupon securities and do not pay interest. They are issued at a discount and are redeemed at face value at maturity. For example, a 91-day treasury bill of Rs. 100 / - (nominal value) can be issued for example Rs. ... calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Disadvantages of Zero-coupon Bonds. There are two major disadvantages of zero-coupon bonds. The first disadvantage is they do not throw off any income as the capital is stored in the bond. In some countries the imputed interest may be taxed as income even though the bond has not yet been redeemed or reached maturity. › treasury-bills-vs-bondsTreasury Bills vs Bonds | Top 5 Differences (with Infographics) Bonds are debt instruments also issued by the government or corporate for tenure equal to or more than 2 years period. T-bills do not pay any coupon. They are floated as a zero-coupon bond to the investors, they are issued at discounts, and the investors receive the face value at the end of the tenure, which is the return on their investment. › ask › answersTreasury Bonds vs. Treasury Notes vs. Treasury Bills Mar 29, 2022 · Treasury bonds, Treasury bills, and Treasury notes are all government-issued fixed income securities that are deemed safe and secure. T-bonds mature in 20 or 30 years and offer the highest ...

Treasury Bills (T-Bills) - Meaning, Examples, Calculations Treasury bills are a type of zero-coupon security where the central government borrows funds from the individual for a period of 364 days or less. In return, the investors receive interest. These money market instruments provide a return on investment at once, and there is no provision for periodic returns. United States Treasury security - Wikipedia Treasury bills ( T-bills) are zero-coupon bonds that mature in one year or less. They are bought at a discount of the par value and, instead of paying a coupon interest, are eventually redeemed at that par value to create a positive yield to maturity. Frequently Asked Questions - U.S. Department of the Treasury The par yield curve is based on securities that pay interest on a semiannual basis and the yields are "bond-equivalent" yields. Treasury does not create or publish daily zero-coupon curve rates. Does the par yield curve only assume semiannual interest payment from 2-years out (i.e., since that is the shortest maturity coupon Treasury issue)? No. › bills-bonds › treasury-bondsTreasury Bonds | CBK May 16, 2022 · five year and fifteen year fixed coupon treasury bonds issue nos. fxd 1/2013/5 & fxd 2/2013/15: 25/03/2013: two year and re-opening of ten year fixed coupon treasury bonds issue nos. fxd 2/2013/2 & fxd 1/2012/10: 25/02/2013: two and fifteen year fixed coupon treasury bonds issue nos. fxd 1/2013/2 & fxd 1/2013/15: 09/01/2013

A guide to US Treasuries Treasuries are issued in six main structures. Usually, the longer the maturity, the higher the interest rate, or coupon.. Treasury bills (T-bills): T-bills have the shortest maturities at four, eight, 13, 26, and 52 weeks. T-bills are typically issued at a discount to par (or face) value, with interest as well as principal paid at maturity.

Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .)

Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Zero-Coupon Bond Price Formula To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000.

Treasury Coupon Issues | U.S. Department of the Treasury Treasury Coupon Issues The Yield Curve for Treasury Nominal Coupon Issues (TNC yield curve) is derived from Treasury nominal notes and bonds. The Yield Curve for Treasury Real Coupon Issues (TRC yield curve) is derived from Treasury Inflation-Protected Securities (TIPS).

Tax on US Treasury STRIPS | Finance - Zacks With a zero coupon Treasury bond, you must pay taxes on the imputed or phantom interest each year. The $100,000 STRIP purchased for $51,400 has a yield to maturity of about 3.3 percent; so in the ...

why is treasury bill also called as zero coupon bonds - Brainly.in 27 answers. 3.2K people helped. A zero coupon bond is a bond which is issued at a price which is less than its face value and, is repaid at its face value on the date of its maturity. Since treasury bills follow this rule, they are also called zero coupon bonds. Niccherip5 and 7 more users found this answer helpful. heart outlined. heart outlined.

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1 Here are some general characteristics of zero coupon bonds: Issued at deep discount and redeemed at full face value

Treasury Bills (BOTs) - MEF Department of Treasury Treasury Bills are issued with maturities equal to or less than one year and are listed in the regulated retail and wholesale markets. Thanks to their being zero-coupon bonds, they are convenient to manage: the financial outflow required for this kind of investment is usually less than the nominal redemption value. Moreover, there is no need to ...

U.S. Treasury Bonds, Bills and Notes: What They Are and How to Buy U.S. Treasury bonds are fixed-income securities issued and backed by the full faith and credit of the federal government, which means the U.S. government must find a way to repay the debt. Given ...

Government - Continued Treasury Zero Coupon Spot Rates* 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot (Zero ...

Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly when...

What Is a Treasury Bill? T-Bills Defined | GOBankingRates Treasury Bills Versus Bonds and Other Securities Treasury bills, notes and bonds are all fixed-income investments sold by the U.S. government to fund debt and pay expenses. The bill is a zero-coupon security that does not pay interest until it matures. Unlike bonds and notes, which accrue interest periodically, the...

What is Treasury Bill (T-bill)? - Indian Economy Treasury bills are presently issued in three maturities, namely, 91 day, 182 day and 364 day. Treasury bills are zero coupon securities and pay no interest. Rather, they are issued at a discount (at a reduced amount) and redeemed (given back money) at the face value at maturity.

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

› investing-firm › treasuryTreasury Brokers: Bonds, Bills, Notes Buying Cost in 2022 Marked as TIPS, these bonds adjust up or down as the consumer price index changes. The minimum order at Schwab for Treasuries is $1,000. The broker does not charge any commissions for Treasury bonds, notes, and bills on the secondary or primary market. Zero-coupon Treasuries and STRIPS are $1 each, with a $10 minimum and a $250 maximum.

Zero-Coupon Bond - Definition, How It Works, Formula It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds.

:max_bytes(150000):strip_icc()/dotdash_INV_final_Discount_Yield_Jan_2021-01-fc704294a32348a7bc00e0fc7652b88e.jpg)

Post a Comment for "44 are treasury bills zero coupon bonds"